Blog

Latest Posts

Blog Posts Moving To Substack

One thing I’ve struggled with since writing my book on Berkshire Hathaway, starting a YouTube Channel, and founding Watchlist Investing is how to tie it all together. I think Substack is the answer. My plan is to send out an email 2-3x/week. The goal...

Read More

Buffett, Berkshire, and Teaching: Why This Blog Exists (Pinned)

I thought it only proper to kick off this blog with the “why” for its existence. I’m a lifelong student of Berkshire Hathaway, Warren Buffett and Charlie Munger, and just about anything connected to them. Even after eight Berkshire Hathaway...

Read More

Acquirer’s Multiple Podcast with Tobias Carlisle (5/24/21)

https://www.youtube.com/watch?v=bKWd-Mp9OB8

Read More

Columbia Business School/Gabelli Interview May 1, 2021

https://www.youtube.com/watch?v=alxbf8F0-hY

Read More

Accent Wealth Podcast Interview

I recently sat down (virtually) with Aznaur Midov to discuss the book. We touched on a lot in this wide-ranging interview. Enjoy!

Read More

In Defense of High Share Prices

Yes, the title of this post is click-bait-y. I’m not here to justify the seemingly high valuations in the current stock market (more in the general commentary section). It’s the proliferation of low-to-no-cost trading and the advent of fractional shares...

Read More

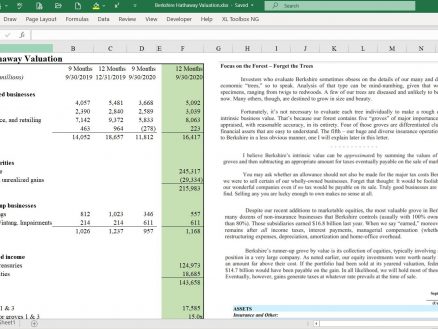

Berkshire Hathaway Intrinsic Value Calculation – Q3-2020

https://youtu.be/lIoLlnJ4p4s

Read More

Do Profit Margins Really Matter?

“Your margin is my opportunity.” – Jeff Bezos The trouble with the analysis of a single variable is the loss of context. Take profit margins. Higher would seem to be better, right? Not necessarily. Let’s consider the following hypothetical companies....

Read More

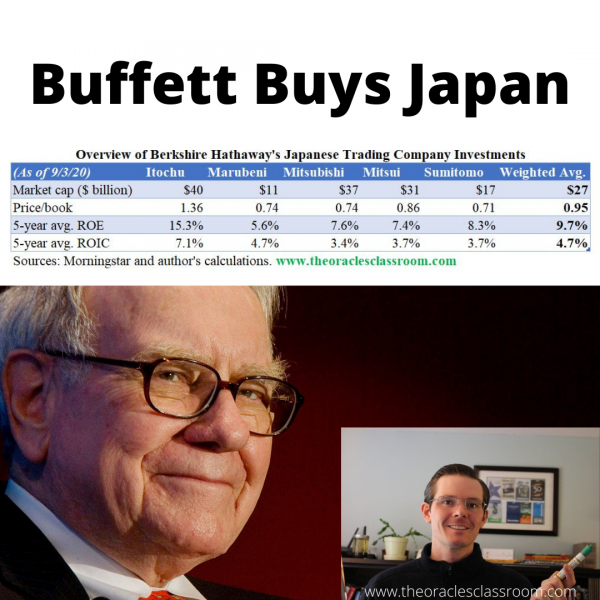

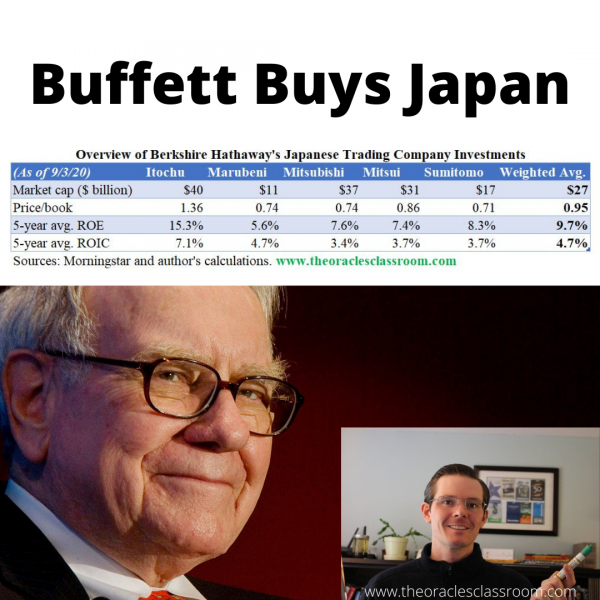

Berkshire Invests $6bn in Japan

On August 31, Berkshire announced that over the prior 12 months it had acquired 5% passive stakes in five Japanese "trading companies". These businesses are more akin to conglomerates and include: Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo. Berkshire noted in the...

Read More

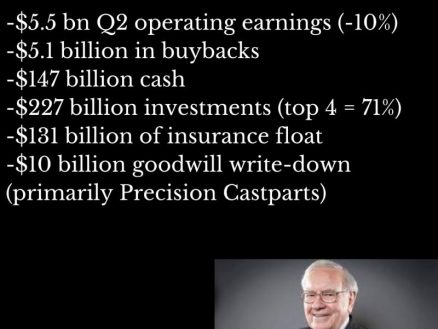

Berkshire Q2 Recap

Berkshire just released its second quarter results. The conglomerate, being so widely diversified, is also a good general barometer for the American economy. Here are the highlights: Operating earnings of $5.5 billion (down 10%); excluding a $10 billion goodwill write...

Read More

The Math Behind Berkshire’s “Secret” Buybacks

Buffett's annual donation of Berkshire shares to philanthropies has tipped off investors that Berkshire has been buying shares in the market since the last 10Q filing was made in April. The articles don't give the math behind how this was...

Read More

Accounting Adventures: The Case of the Missing $166 Million at Berkshire Hathaway

In 2019, Berkshire Hathaway repurchased $5 billion of its own shares. Or did it? There was a difference of $166 million between what the statement of shareholders' equity said the company repurchased and what the statement of cash flows said....

Read More

The Real Reason Buffett Sold Berkshire’s Airline Stocks

The basic framework Warren Buffett uses to examine companies can help us understand why he sold Berkshire's investments in airlines. That framework is rooted in economics and can be expressed as an equation: Investment Return = Capital Intensity x Profit...

Read More

Page-by-Page Analysis of Warren Buffett’s 2019 Berkshire Hathaway Annual Report

Walk through the 2019 Berkshire Hathaway Annual Report page-by-page. The five-hour series is broken into four parts starting with Warren Buffett's Chairman's letter. Timestamps in each video link to EACH page of the Annual Report (you must view from YouTube)...

Read More

Market Misfires: ZOOM

Investors recently bid up Zoom Technologies (ticker: ZOOM) thinking it was Zoom Video Communications (ticker: ZM). ZOOM is a tiny Chinese company that makes mobile devices and handsets. ZM is the popular video conferencing company based in the United States....

Read More

Newspapers are today’s textiles: Why Berkshire was right to sell its newspaper business.

Berkshire recently entered into an agreement to sell its newspaper business to Lee enterprises for $140 million. It was the right move, and not just for financial reasons. Taking one big public hit now is far better for Berkshire's reputation over...

Read More

Investing for 1,000 Years: Taking the (Very) Long View

Anyone who has studied Warren Buffett for more than five minutes knows that he takes a long-term view. Up until a few years ago I did not realize just how long “long” really was, and what that frame of mind...

Read More

Applying Value Investing Principles to Everyday Business

Warren Buffett’s quote about price and value is often used in the context of investing. The wisdom contained in it is applicable in the everyday world of business. In the financial world the phrase means an investor should pay attention...

Read More

Understanding Your Circle of Competence: Buffett’s 2009 Investment in Harley Davidson

Berkshire Hathaway's $300 million investment in Senior Notes to Harley-Davidson provides insight into Buffett’s investment decision making and circle of competence. In February 2009 Berkshire participated in a $600 million debt offering that carried a 15% coupon rate. Too small...

Read More

Accounting is weird: Buffett’s accounting decision on Blue Chip Stamps

When Berkshire Hathaway’s investment in Blue Chip Stamps crossed the 20% mark in 1973 it presented Buffett with a unique accounting decision: which period of earnings to include in Berkshire’s financials. Crossing the 20% ownership mark required Berkshire to report...

Read More

Deferred Taxes – A Partner in Uncle Sam

As a consequence of a long-term, low-turnover approach, a portfolio necessarily generates deferred tax liabilities. These are taxes which would be owed on capital gains (net of any taxable capital losses) if every security were liquidated. Securities held for less...

Read More

When Newspapers and Oil Wells are Economic Equals: A Lesson on Valuing Cash Flow

One of the most enjoyable things about studying Charlie Munger is seeing his multidisciplinary thought process in action. As is often the case with Munger, and his partner, Warren Buffett, insights are at the same time disconnected at the surface...

Read MoreMost Popular

-

Blog Posts Moving To Substack

-

Buffett, Berkshire, and Teaching: Why This Blog Exists (Pinned)

-

Acquirer’s Multiple Podcast with Tobias Carlisle (5/24/21)

-

Columbia Business School/Gabelli Interview May 1, 2021

-

Accent Wealth Podcast Interview

-

In Defense of High Share Prices

-

Berkshire Hathaway Intrinsic Value Calculation – Q3-2020

-

Do Profit Margins Really Matter?

-

Berkshire Invests $6bn in Japan

-

Berkshire Q2 Recap

-

The Math Behind Berkshire’s “Secret” Buybacks

-

Accounting Adventures: The Case of the Missing $166 Million at Berkshire Hathaway

-

The Real Reason Buffett Sold Berkshire’s Airline Stocks

-

Page-by-Page Analysis of Warren Buffett’s 2019 Berkshire Hathaway Annual Report

-

Market Misfires: ZOOM

-

Newspapers are today’s textiles: Why Berkshire was right to sell its newspaper business.

-

Investing for 1,000 Years: Taking the (Very) Long View

-

Applying Value Investing Principles to Everyday Business

-

Understanding Your Circle of Competence: Buffett’s 2009 Investment in Harley Davidson

-

Accounting is weird: Buffett’s accounting decision on Blue Chip Stamps

-

Deferred Taxes – A Partner in Uncle Sam

-

When Newspapers and Oil Wells are Economic Equals: A Lesson on Valuing Cash Flow