Warren Buffett’s quote about price and value is often used in the context of investing. The wisdom contained in it is applicable in the everyday world of business.

In the financial world the phrase means an investor should pay attention to the value received relative to price, irrespective to how many digits or commas the price tag contains. Paying a high price is okay so long as one is receiving at least as much in value.

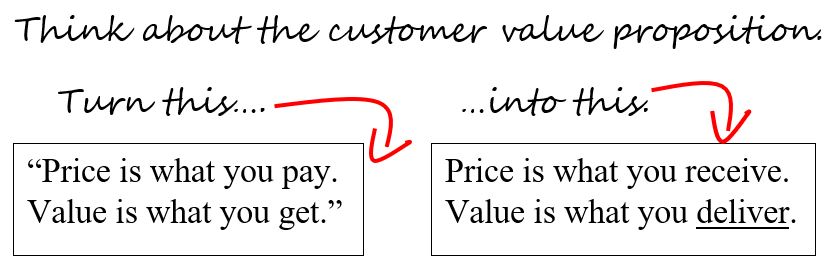

How can this concept be applied to the business world? Turn it around (invert!). If you’re in business, it means you should seek to deliver more in value than the price of your product or service. It doesn’t mean you should give away a lot of value for a low price—that would put you out of business. But the customer should walk away feeling good about spending their money.

Think about that little extra value delivered as an insurance policy. Set your standards slightly above the price at which you charge. If you have an off day or deliver slightly lower than your usual standard, you’re still providing value to the customer. Same goes for if the customer’s perception of value is lower than you thought you delivered: you have a margin of error built in to protect your reputation.

And if all goes well and you deliver that extra value to the customer? Think of it as a marketing strategy: highly satisfied customers are more likely to refer new business to you than the reverse.

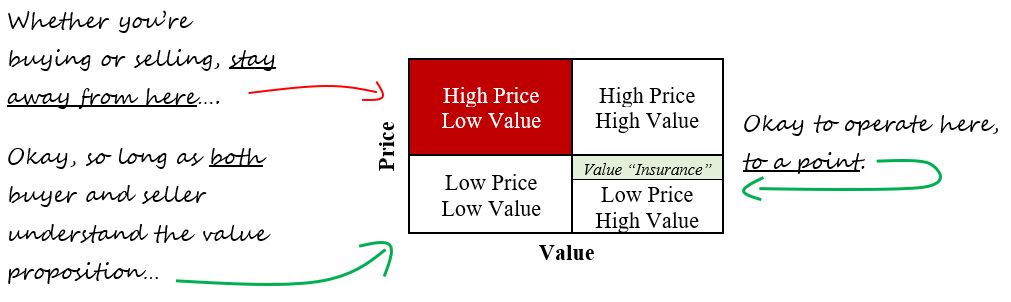

It can be helpful to visualize the space in which you want to operate with a four-block grid, with price on the vertical axis and value on the horizontal.

Low price, low value: Operating in this segment is okay, so long as each party understands what’s being given and received. These are the birthday favor trinkets that break after one use. The manufacturer doesn’t invest much in making them high quality because they know they’re going to be thrown away after one use, and the customer likewise agrees and gladly parts with their few dollars.

High price, low value: The upper righthand side is where you want to avoid at all costs. Whether you’re buying or selling, a high price coupled with low value is a recipe for disaster. At best it will result in few to no customers as the market correctly appraises the value of the product as not worth the cost. At worst, a business or person that employs this strategy might garner a reputation for ripping off their customers. They might enjoy strong profits in the short-term only to find their customers desert them once they figure out the sub-par value proposition. Don’t do it.

High price, high value: This is buyer of the Lamborghini or the Tiffany necklace or the top-line appliance that knows exactly what they’re getting. They’re okay parting with a lot of their money because they understand there can be a relationship between price and value and want to receive high value by paying a high price. If you operate in this quadrant make sure you can point to evidence of the value you’re delivering.

Low price, high value: It’s okay to operate slightly within this segment if you can economically deliver the product or service. Right at the edge is where value creation and customer loyalty happens. The deeper one goes into delivering a lot of value at a low price the more customer loyalty that can be generated—to a point. At some point there’s too much value being delivered for the price point. This can ultimately lead to the company going out of business, or the individual burning out from exhaustion.

While not perfect, understanding where your product or service, or your own personal value creation, falls on the spectrum of price/value can be of great use. It can lead to changes in the way a produce or service is marketed, delivered, its quality, or even a revisiting of its price point.

In all cases it’s important to build in a margin of safety and deliver excess value as an insurance policy. There are two ways to deliver extra value. One is by keeping price the same and delivering more value per unit of price. The other is by charging a lower price.

Seek to deliver a little more in value than you’re receiving in price and you’ll find you have happy (and repeat) customers—and most likely a sustainable business with a healthy bottom line.