When Berkshire Hathaway’s investment in Blue Chip Stamps crossed the 20% mark in 1973 it presented Buffett with a unique accounting decision: which period of earnings to include in Berkshire’s financials.

Crossing the 20% ownership mark required Berkshire to report its proportional share of Blue Chip’s earnings on its financial statements. But because Blue Chip’s year end was February[1] compared to Berkshire’s calendar year end, it caused Berkshire to decide which period to include.

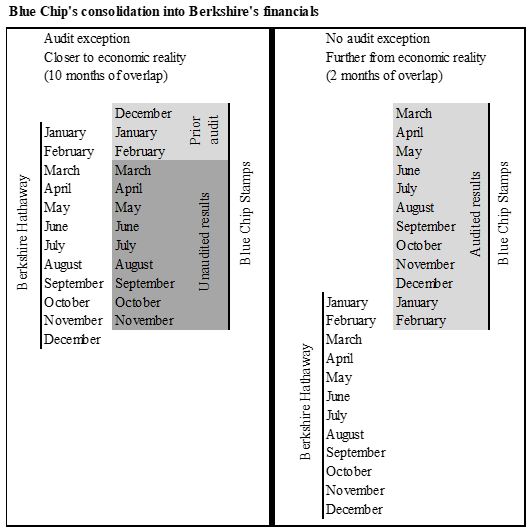

One option, which would be blessed by Berkshire’s auditors, was to use the earnings and ownership level as of Blue Chip’s prior audit. This would mean including the twelve months ended February 1973[2] in Berkshire’s results for the twelve months ended December 31, 1973. Buffett said that “such an approach seemed at odds with reality” considering the ten month lag and chose another option.

He chose to use the unaudited results of Blue Chip for the twelve months ended November 1973. Even though Berkshire auditors couldn’t officially okay them, this choice resulted in just two months of Blue Chip’s results falling outside of Berkshire’s instead of ten.

This extreme example illustrates the choices management has in reporting results to shareholders. The “easy” choice would have been to combine the two sets of books okayed by auditors but almost an entire year apart. Which is just weird.

[1] Technically it was the Saturday closest to February 28, which sometimes caused the year end to fall into the beginning of March.

[2] Technically March 3, 1973.