Berkshire just released its second quarter results. The conglomerate, being so widely diversified, is also a good general barometer for the American economy. Here are the highlights:

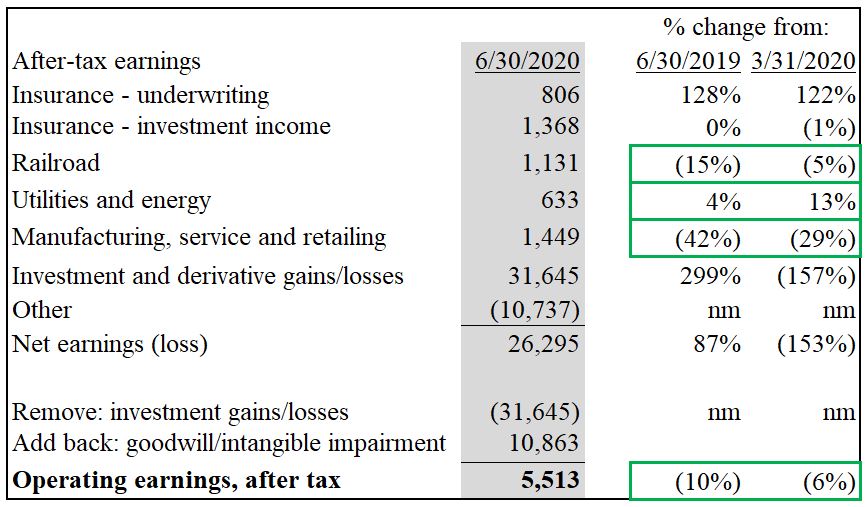

- Operating earnings of $5.5 billion (down 10%); excluding a $10 billion goodwill write down

- Share repurchases of $5.1 billion

- $147 billion of cash at quarter end

- $227 billion of investments at quarter end

- $131 billion insurance float

Let’s dig in:

- Insurance underwriting: Insurance results from quarter to quarter are almost meaningless due to the impact of reinsurance. That’s no different today, though GEICO had an unusual quarter. GEICO’s $2 billion quarterly profit was abnormally high. This was in part due to lower losses related to drivers not on the road. The accounting of GEICO’s 15% giveback is such that earned premiums will face a $200 million monthly hit over the next year. If losses remain low this should all wash out (mostly), but if losses revert GEICO could face actual losses. Reinsurance recorded a $1.1 billion loss for the quarter which is not at all uncommon. Some of that was due to deferred charge amortization (a non-cash item), and some was due to unfavorable loss development. COVID-19 claims were $350 million in the quarter.

- Float: Related, insurance float was $131 billion, a $1 billion increase for the quarter. Putting everything in context, Berkshire has use of $131 billion and get paid to hold it, to the tune of $806 million in Q2. Even a diminution of GEICO’s profits shouldn’t hurt that stellar result.

- Railroad: BNSF experienced an 18% drop in volumes during Q2, which translated into the 15% drop in year-over-year profits. Rail remains an essential business and should track general economic results over time. The cost advantages of rail over truck aren’t going away.

- Utilities: The energy business improved profits largely due to a tax credit related to sustainable energy development. Volumes in some units did decline. Overall the energy business as an essential service should be immune to major disruptions.

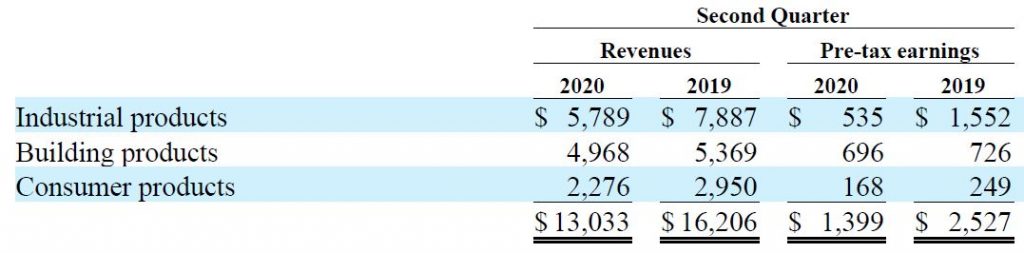

- MSR: The real action happened in this category. Here’s a snapshot from the Q2 report:

Leading the industrial products decline was Precision Castparts, the aerospace company Berkshire acquired in 2016. PCC’s revenues declined 33% and it reported a $78 million loss during the quarter. As a result of the magnitude and duration of the hit to its business, Berkshire took a $10 billion write-down of the goodwill asset account setup upon its acquisition. That write down is real in the sense that it reflects the real decline in earnings power of PCC, but is non-cash in nature and not included in the table above. Lubrizol, Marmon, and IMC, other industrial companies in the category, also suffered large double-digit declines in revenues and earnings.

One bright spot within building products was Clayton Homes. The significant housing stock shortage nationally continues to be a tailwind for Clayton. Its revenues increased 8% quarter-over-quarter, and tis earnings increased 13%.

Consumer products revenues and earnings took a 23% and 33% hit, respectively. This isn’t surprising given the pullback in purchases of such items as furniture, jewelry, and apparel/footwear. Somewhat surprisingly, Forest River, a manufacturer of RVs and other recreational equipment, saw a 26% decline in sales. The press highlighted strong sales of such products as consumers found ways to take vacations away from people. The discrepancy probably lies with the lag between purchases of showroom inventory and manufacturing.

Revenues and earnings at the service businesses fell 22% and 48%, respectively. This group contains such businesses as FlightSafety and NetJets, two very capital intensive businesses. Declines in revenues have a disproportionate effect on earnings.

Berkshire’s valuation remains attractive. A rough “back of the envelope” valuation: Consider the $147 billion in cash and $227 billion in securities (mostly stocks but some fixed income). Those two “buckets” sum to $374 billion. The market is currently valuing Berkshire at $500 billion. That means all of those businesses just mentioned have an implied value of about $125 billion. Even assuming the current quarter holds as the new permanent base of earning power, assuming breakeven underwriting, and giving no credit for investment income (so as not to double count), annualized after-tax earnings would be $13.5 billion. That means the market is saying all of Berkshire’s businesses are worth less than ten times earnings. It’s no surprise at all Buffett and Munger thought the best investment in the quarter to be Berkshire itself, buying back about 1% of the company.

*To reemphasize, nothing in this post or on this site should be considered investment advice. All commentary is the opinion of the author, including calculations of value, which are surely imperfect and could be wrong.