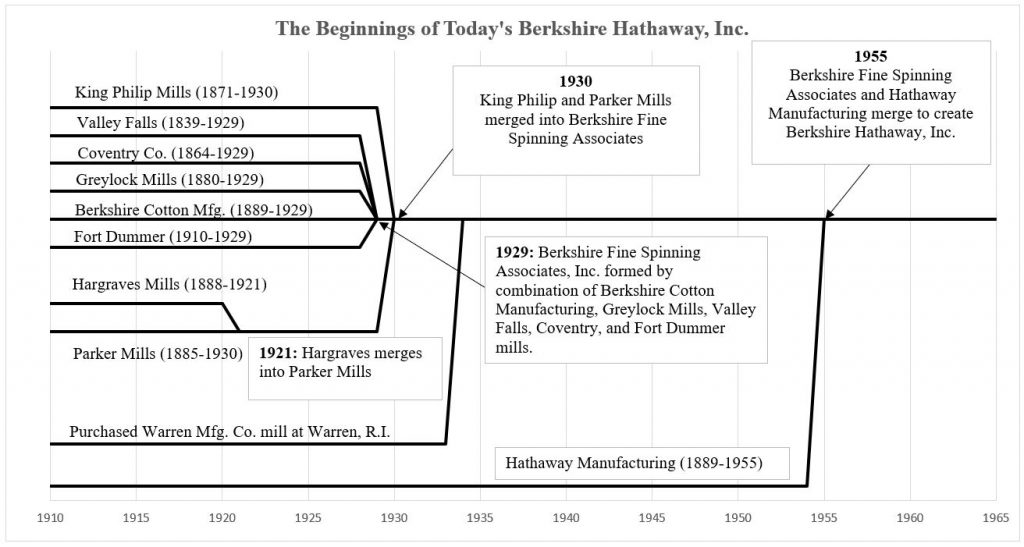

Incorporated in New Bedford, Massachusetts in 1889

Incorporated in Massachusetts in 1888 Merged with Parker Mills in 1921

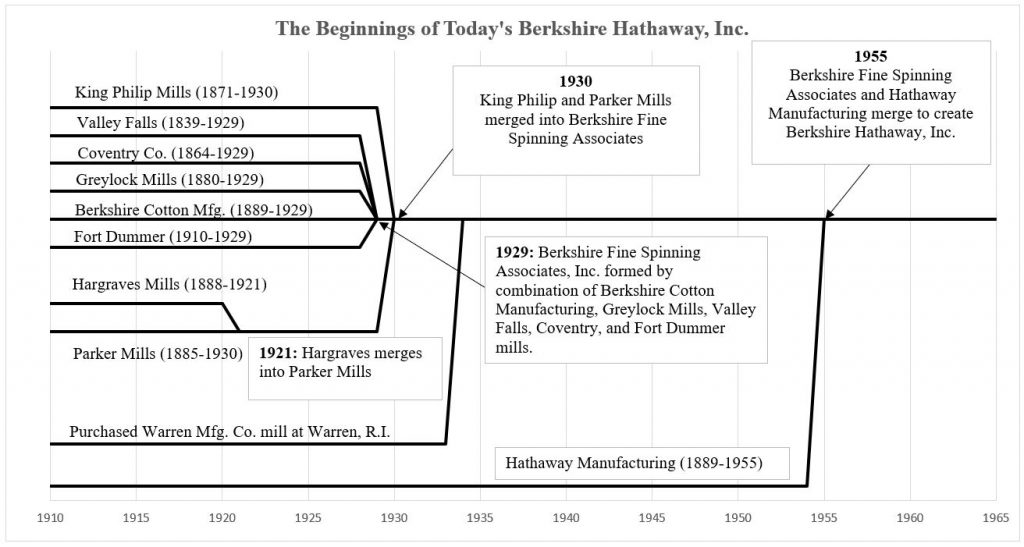

Incorporated in Massachusetts in 1889 Merged to form Berkshire Fine Spinning Associates in 1929

Formed in 1929 from combination of Berkshire Cotton Manufacturing, Greylock Mills, Valley Falls, Coventry Co., and Fort Dummer Mills Merged with Hathaway Manufacturing in 1955 to form Berkshire Hathaway, Inc.

Incorporated in Rhode Island in 1864 Merged to form Berkshire Fine Spinning Associates in 1929

Merged to form Berkshire Fine Spinning Associates in 1929

Incorporated in Massachusetts in 1871 Merged with Berkshire Fine Spinning Associates in 1930

Incorporated in Massachusetts in 1885Merged with Berkshire Fine Spinning Associates in 1930

Berkshire Fine Spinning Associates and Hathaway Manufacturing merge to become Berkshire Hathaway, Inc.

Warren Buffett begins buying shares for his partnership, Buffett Partnership, Limited.

Warren Buffett gains control of Berkshire Hathaway.

Berkshire Hathaway declares a $0.10 dividend, payable in 1967. It would be the last the company would pay - and likely will ever pay - under the direction of Warren Buffett.

Acquired by Berkshire Hathaway in 1967 for $8.6 million (See BRK financials)

Acquired by Berkshire Hathaway in 1969 for approximately $17.7 million (See BRK Financials)

Berkshire first acquires shares in Blue Chip Stamps, taking an initial stake of 6% of the company

Lakeland Fire & Casualty Company

Texas United Insurance

Acquisition of Home & Automobile Insurance Company of Chicago

Berkshire forms Lakeland Fire & Casualty Company in Minnesota, and Texas United Insurance